Blog

Stay up to date with our latest bookkeeping news and resources

Latest Blog Posts

Common Mistakes In Bookkeeping And Accounting (And How To Avoid Them)

Many small business owners handle their own bookkeeping and accounting, but without a structured process, mistakes are easy to make. Errors such as failing to track expenses, misclassifying transactions, or

Outsourcing Bookkeeping: A Solution For Growing Businesses

Managing your books gets more complicated as your business grows. Keeping up with transactions, payroll, and tax deadlines can take hours out of your week—time that could be spent running

How Cloud Bookkeeping Enhances Flexibility And Efficiency

As technology continues to evolve, so do the tools available for managing your books. As a result, cloud bookkeeping has become a new method that is changing the way businesses

How A Small Business Tax Preparation Checklist Can Streamline Your Process

Tax season can be stressful, but it doesn’t have to be. A small business tax preparation checklist is a simple yet powerful tool to help you stay organized, ensure compliance,

12 Effective Tax Preparation And Planning Strategies

Effective tax preparation and planning is essential for any business looking to maximize savings and stay compliant. A well-organized tax strategy helps you reduce your tax liabilities, avoid penalties, and

The Importance Of Compliance: How Bookkeeping And Payroll Services Keep Your Business On Track

From tax laws to labor regulations, the rules seem to multiply every year. But here’s the thing: compliance isn’t just about avoiding trouble. It’s about setting your business up for

Accounting Solutions For Effective Debtors Management

Do you ever feel like you have to continuously balance your business’s bills and payments? Do you find it difficult to plan ahead with your money and know what to

Finding the Right Affordable Tax Service: What To Look For

Tax season can be a stressful time for small business owners. It’s easy to feel stressed when you have to deal with financial issues and complicated tax laws. Affordable tax

Professional Accounting And Tax Services Can Improve Cash Flow Management

Do you ever feel like you have to continuously balance your business’s bills and payments? Do you find it difficult to plan ahead with your money and know what to

Making The Most Of Tax Savings Through Proper Bookkeeping In NJ

Running a business in New Jersey (NJ) presents a unique blend of opportunities and challenges. NJ’s strategic position, broad economy, and lively market attract business owners. However, strict governmental restrictions,

The Importance Of Accurate Bookkeeping For Ecommerce

Running an ecommerce business can be incredibly rewarding, but it also comes with its own set of unique challenges. With hundreds or even thousands of transactions flowing through your online

Outsourcing Accounting Services For Ecommerce Business Optimization

Are you an ecommerce entrepreneur looking to streamline your operations and drive growth? One area that often gets overlooked but can have a significant impact on your success is financial

15 Tips For An Effective DIY Bookkeeping Clean Up

Having a regular bookkeeping clean up session is essential for the maintenance of your accounting records. In this blog post, we’ll look at the importance of cleaning up your accounting

How Outsourced Bookkeeping Can Reduce Overheads And Boost Profitability

Tackling in-house bookkeeping can feel like a relentless task. The constant struggle to track every dollar in and out not only consumes time but often results in potential errors that

10 Benefits Of Outsourced Bookkeeping Services

Running your own business can be one of the most rewarding experiences, however, it also has many challenges, particularly regarding cash flow and the management of finances. Staff overheads are

Why You Should Hire A Bookkeeper

When you hire a bookkeeper for your small business, you’re making a strategic decision that can impact your business positively. As a business owner, your time is valuable and should

Bookkeeping Services For Home Builders

At Rakow & Co, we’ve had the privilege of providing bookkeeping services for home builders for many years. In our extensive experience, there are unique financial challenges home builders face

Bookkeeping For Mental Health Professionals – 6 Best Practices For Your Business

As a mental health professional, your passion lies in helping clients and providing superior care. Bookkeeping shouldn’t consume your thoughts and stir financial worries in your life. As a health

Form 5472 & Other Tax Forms Foreign-Owned LLCs Must File

Owning a business as a foreign entity in the United States can be a rewarding venture. However, it also comes with obligations, one of those being filing your taxes, for

Free Up Your Time with Virtual Bookkeeping Services

There are many benefits that you, as a small business owner, can reap from virtual bookkeeping services. In this blog, we’ll take a look at five main ones. Managing bookkeeping

Top Mobile Accounting Apps For Small Businesses

The way business is done today is highly flexible – it helps if your accounting is mobile too. Imagine you run a business and you’re out grabbing a coffee before

Why You Need A Construction Accountant

How To Improve Your Construction Accounting If you’re in the construction industry, you know that it’s not just about putting on a hard hat and watching the dollars pour in.

How A Virtual Bookkeeper Will Clean Up Your Books

As a small business owner, we know you’re a master of multitasking – juggling a long list of activities and trying to prioritize your time. It’s no surprise that your

What Is An EIN Number, How To Get It & Why You Need It

An Employer Identification Number (EIN) number is a unique nine-digit identifier similar to a social security number. However, EINs are used to identify businesses for tax and administrative purposes. This

A Guide To Online Bookkeeping Services

Handling finances as a small business owner can be intimidating and complex. The good news is that you can delegate these tasks to an online bookkeeping service. This will take

Payroll Solutions – How To Choose One

Running payroll is a critical aspect of any small or large business. It involves keeping track of the salary paid to each employee and other factors like benefits, pension and

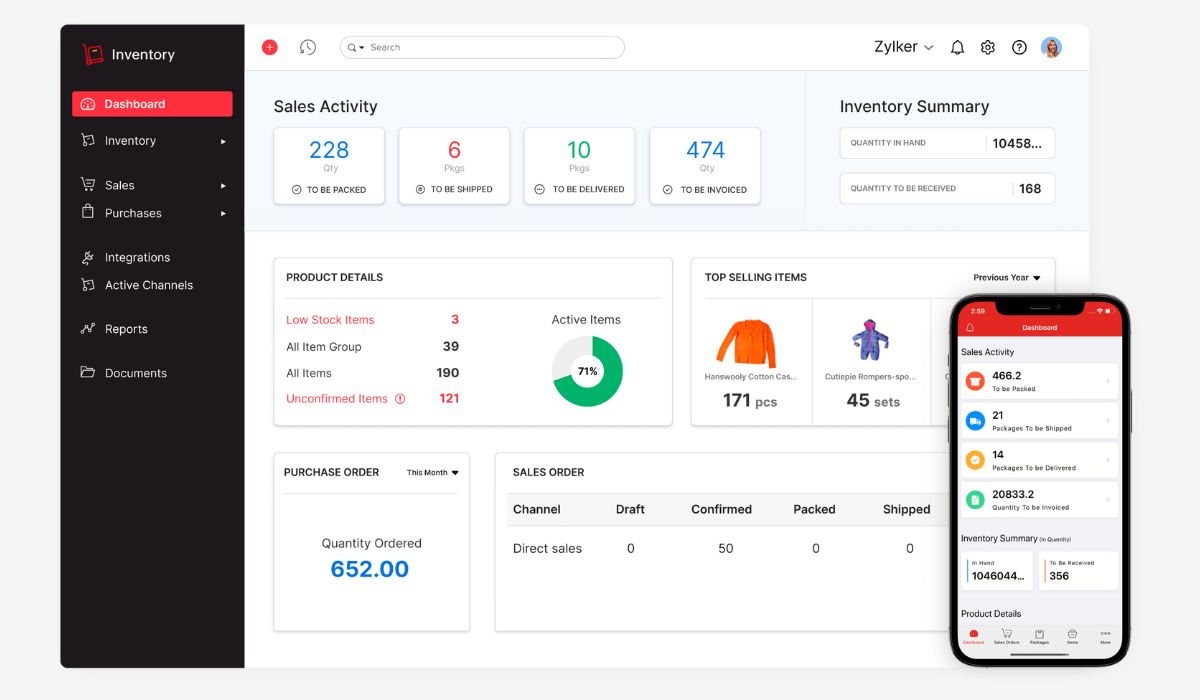

5 Top Ecommerce Inventory Management Tools for 2023

Managing inventory effectively is crucial for the success of any ecommerce business. Making mistakes in your forecasting, counting or tracking can lead to inadequate stocks, unnecessary purchases and shipment delays.

The e-Commerce Inventory Management Guide

If you’re thinking about starting an ecommerce store you will want to read this ecommerce inventory management guide before you do. It might sound easy to get yourself setup on

Outsourced Bookkeeping Services

Which Accounting Services Can Be Outsourced? The Benefits Of Outsourcing A small business that starts to experience rapid growth will very quickly start investigating options like outsourced bookkeeping services, outsourced

Small Business Tax Deductions Checklist

Our checklist of 25 tax deductions that small businesses & self employed persons should know about in 2023 According to the IRS a business expense is tax deductible if it